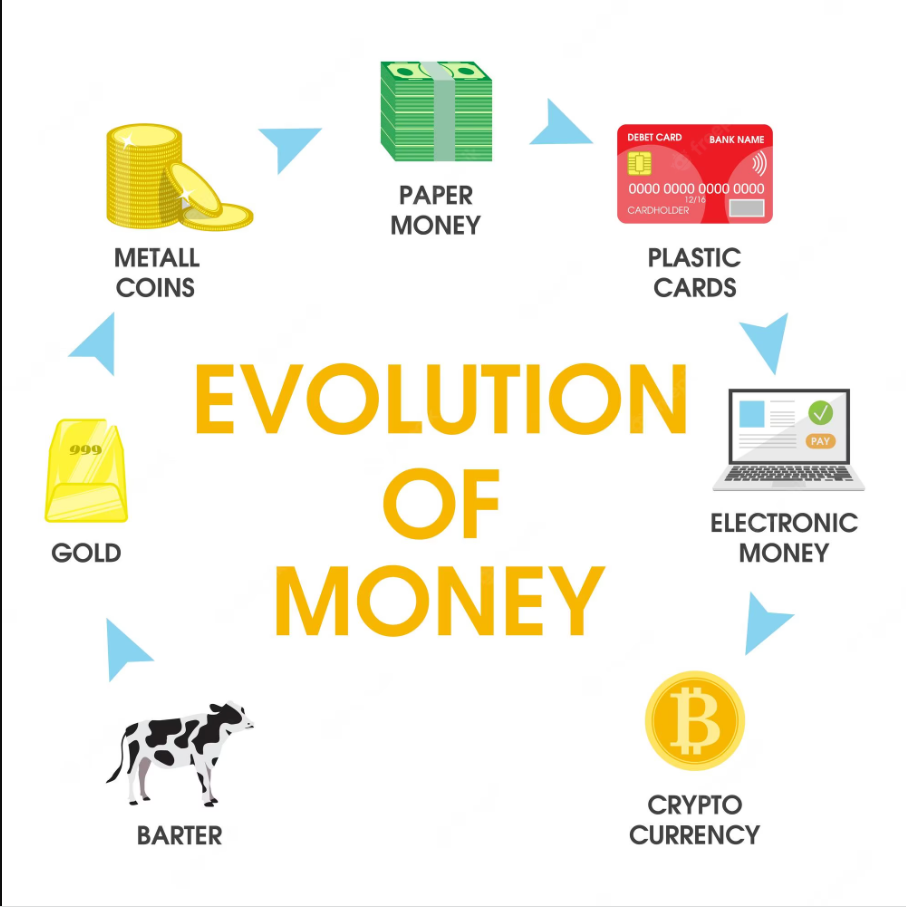

Evolution of Money

The evolution of money is a fascinating journey that spans thousands of years. It began with primitive forms of trade by barter and gradually evolved into the complex financial systems we have today. Here’s a breakdown of the key stages in the evolution of money:

-

Barter System (Prehistoric Times – Before 6000 BCE):

- In the earliest human societies, people exchanged goods and services directly through barter. This system involved trading one commodity for another without using any standardized medium of exchange.

- Barter was limited by the “double coincidence of wants” problem, where both parties had to desire what the other had to offer.

-

Commodity Money (6000 BCE – 1000 BCE):

- As societies grew more complex, they started using certain commodities with intrinsic value as a medium of exchange. These commodities were widely accepted and held value in themselves.

- Examples of commodity money include cowry shells, salt, precious metals (gold, silver), and agricultural products.

-

Metal Coins (1000 BCE – 600 BCE):

- Metal objects, particularly precious metals like gold and silver, became standardized and shaped into coins. Coins were easier to carry and allowed for more efficient trade.

- Governments and ruling authorities started minting coins with specific weights and markings to guarantee their value.

-

Paper Money (7th – 15th Century):

- To facilitate long-distance trade and reduce the burden of carrying heavy metal coins, various societies started using promissory notes or certificates representing stored coins or commodities.

- These early forms of paper money gradually gained acceptance, especially in China and the Islamic world.

-

Banknotes (17th Century – Present):

- The modern concept of paper money as we know it today originated in Europe during the 17th century. Governments and banks began issuing standardized banknotes backed by reserves of precious metals or other assets.

- As economies grew, the link between paper money and physical commodities was gradually abandoned, and fiat money (money without intrinsic value, backed only by trust in the issuing authority) emerged.

-

Digital Money and Electronic Payments (Late 20th Century – Present):

- With the rise of computers and the internet, digital money and electronic payment systems became prevalent. Credit cards, debit cards, and online payment platforms enabled seamless transactions without physical cash.

-

Cryptocurrencies (2009 – Present):

- The advent of blockchain technology in 2009 led to the creation of Bitcoin, the first decentralized cryptocurrency. Cryptocurrencies operate independently of central authorities, relying on cryptographic principles for security.

- Since Bitcoin’s launch, thousands of other cryptocurrencies have been developed, each with unique features and use cases.

-

Digital Currencies by Central Banks (Central Bank Digital Currencies – CBDCs) (2010s – Present):

- Some central banks are exploring the concept of issuing digital versions of their national currencies known as CBDCs. CBDCs aim to provide a digital form of legal tender backed by the issuing government.

Throughout history, money has evolved to meet the changing needs of societies and economies. While cryptocurrencies and digital currencies represent the latest advancements, the core functions of money as a medium of exchange, a unit of account, and a store of value remain constant.

Have Any Questions?

Do you have any question you could not get the answer here?

Any addition, Suggestion or removal?

BitWay Academy is a product of BitWay Technologies, A platform to educate over 100,000 Africans on how to start their cryptocurrency journey.

We want every AFRICAN to have good and sound cryptocurrency knowledge